Disability

According to a 2016 survey, nearly 70 percent of

Americans have less than $1,000 in their savings.1

Should you be unable to work due to illness

or injury, it’s likely your savings wouldn’t last long

for things such as mortgage, groceries, utilities…

or much else.

THINK ABOUT IT

Your income provides everything, from

your home to car to utilities and groceries.

If you can’t work, everything can change in an

instant. If that happens, you want to believe

that your everyday life, although disrupted,

will keep moving forward.

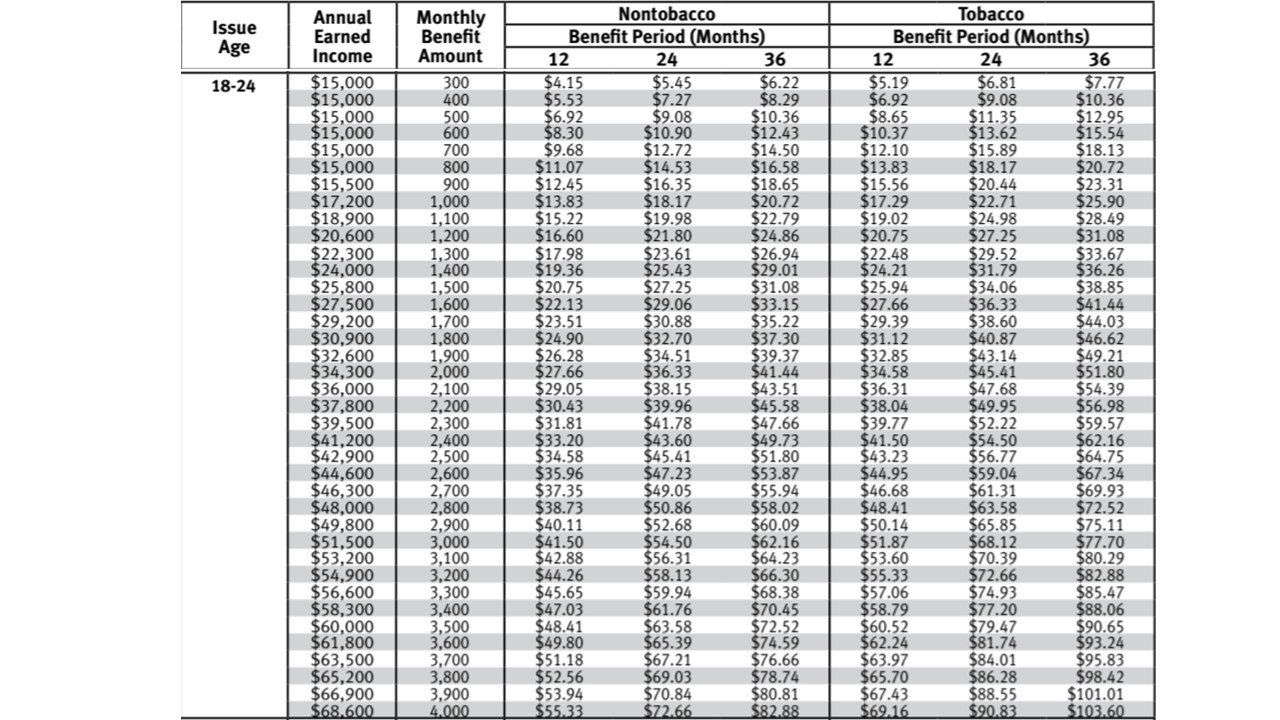

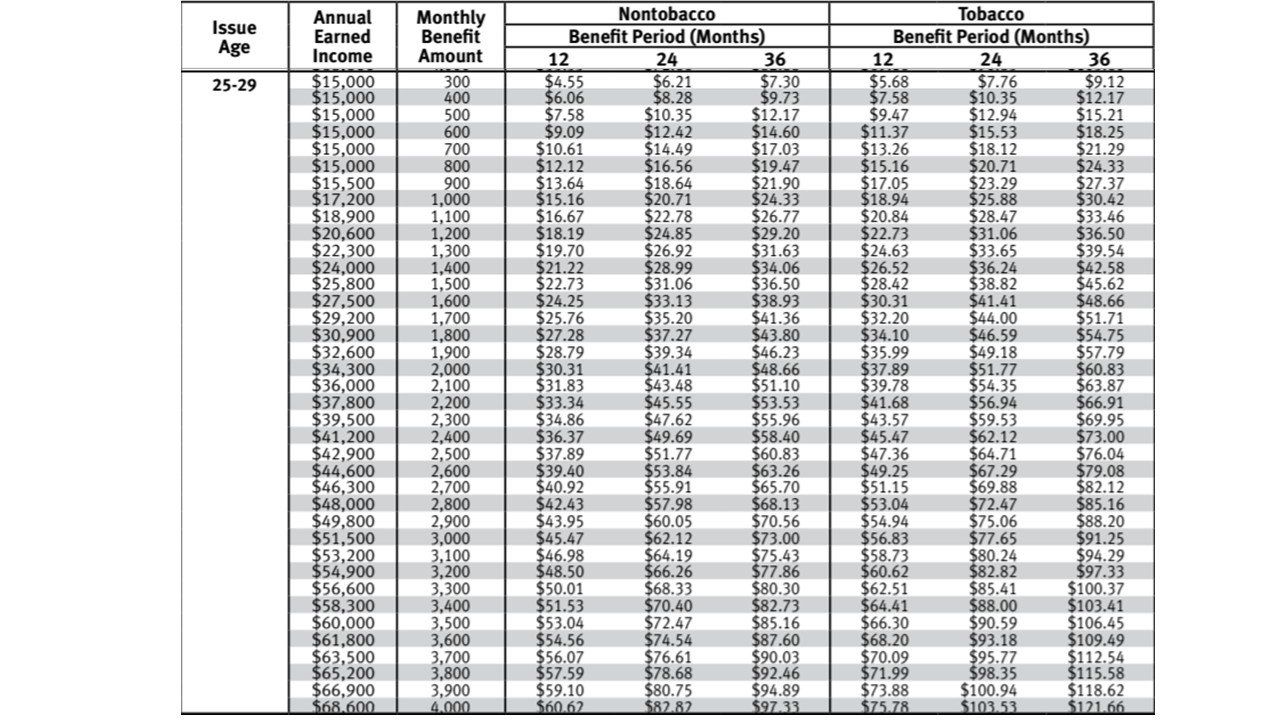

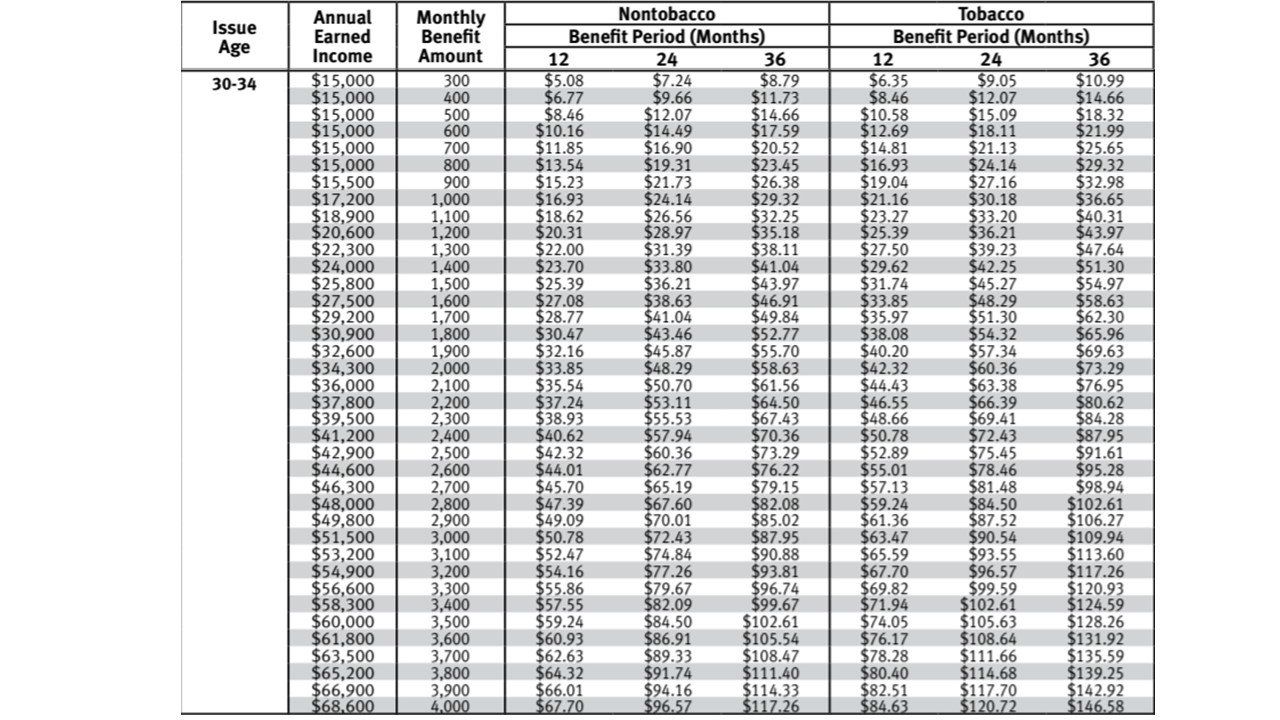

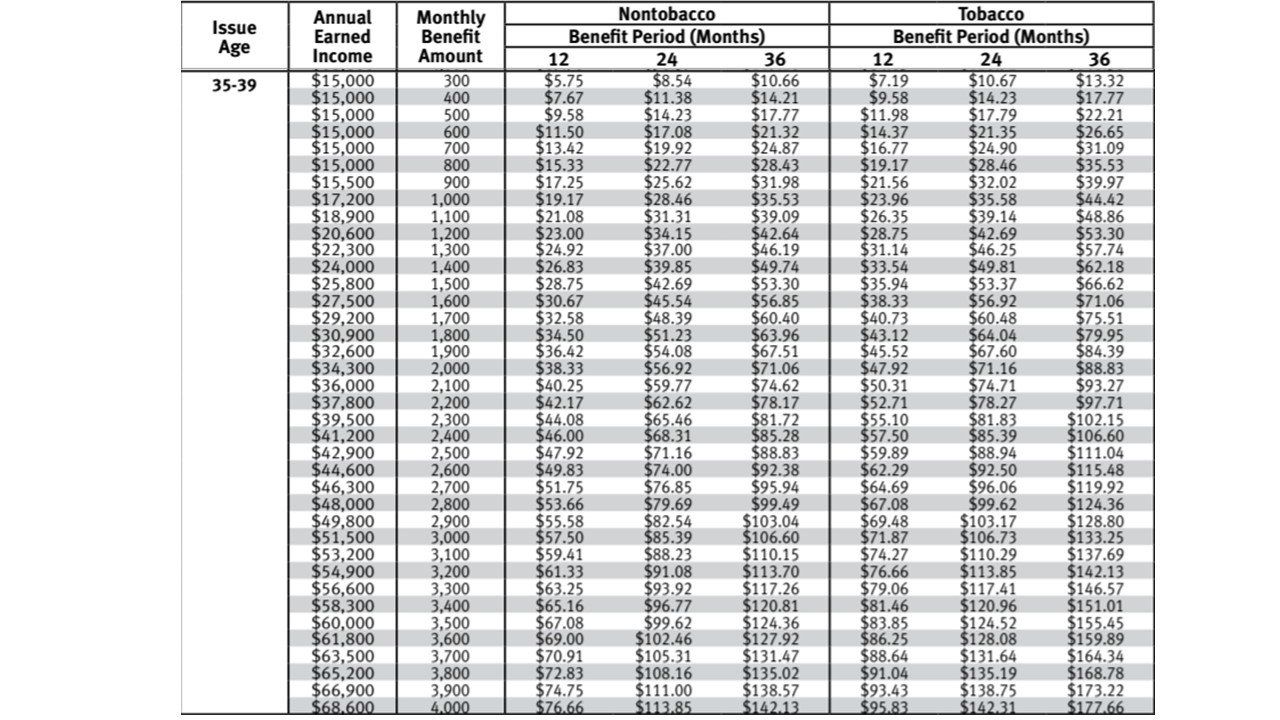

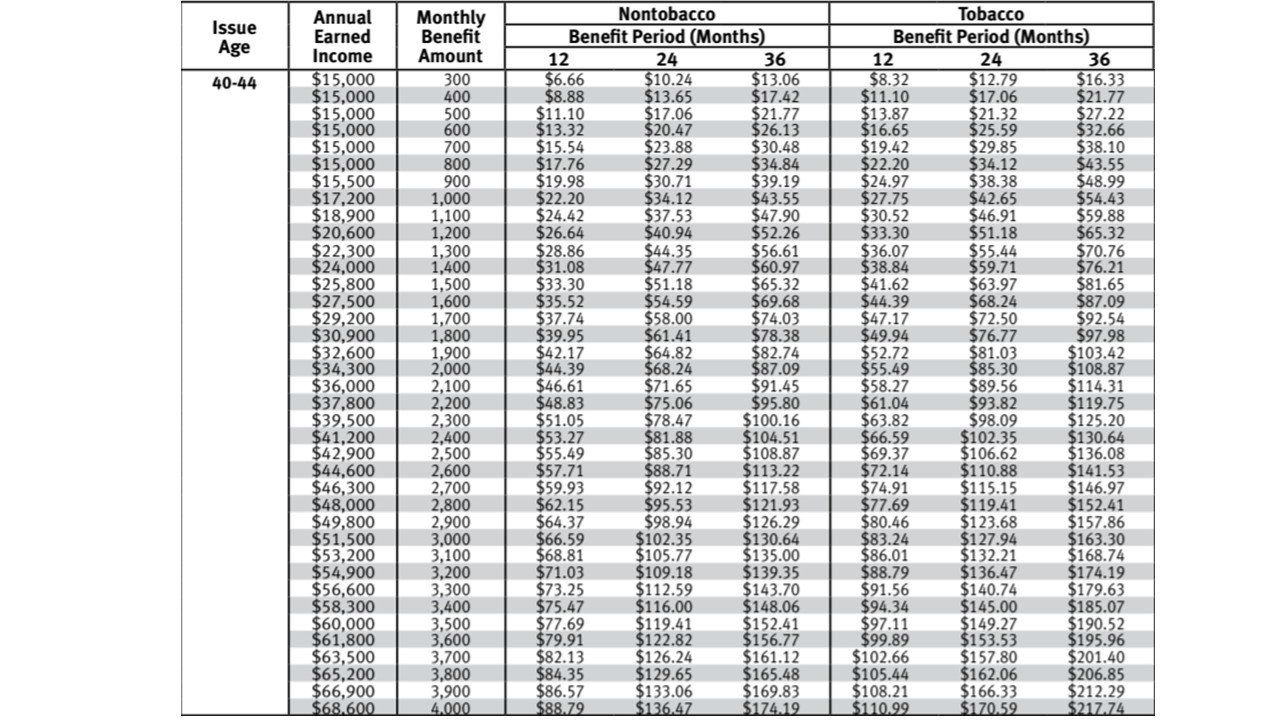

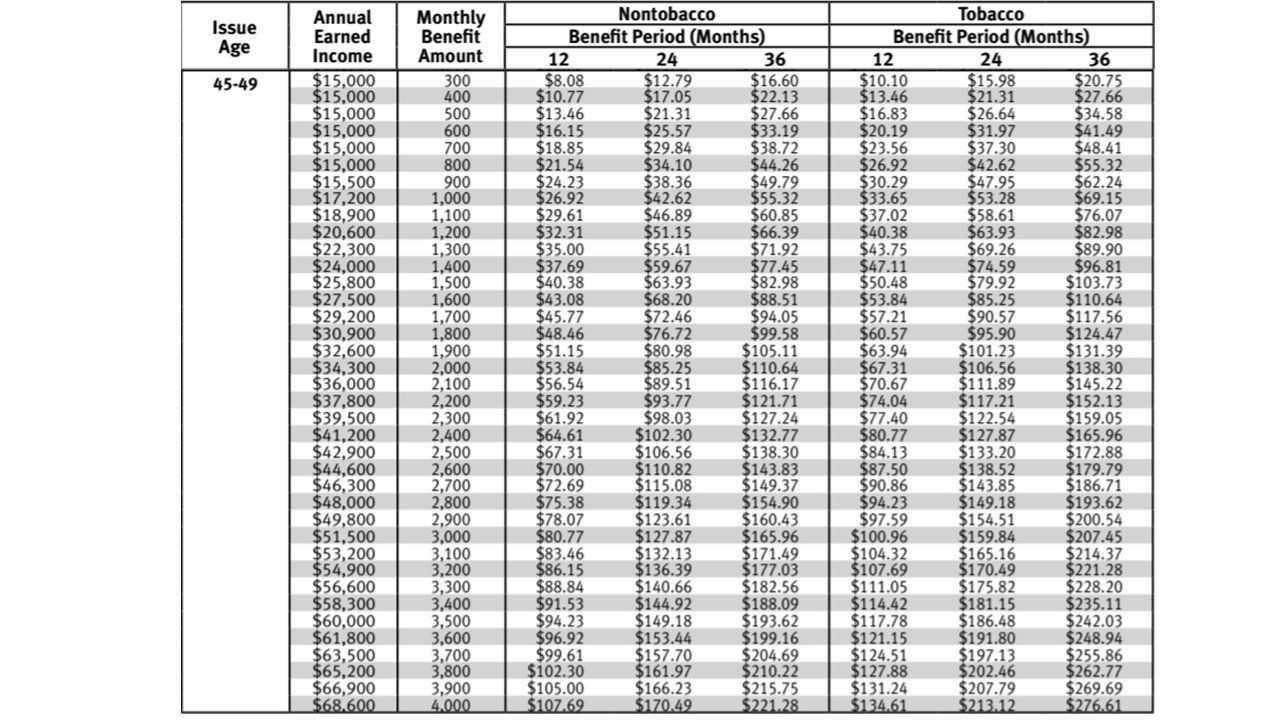

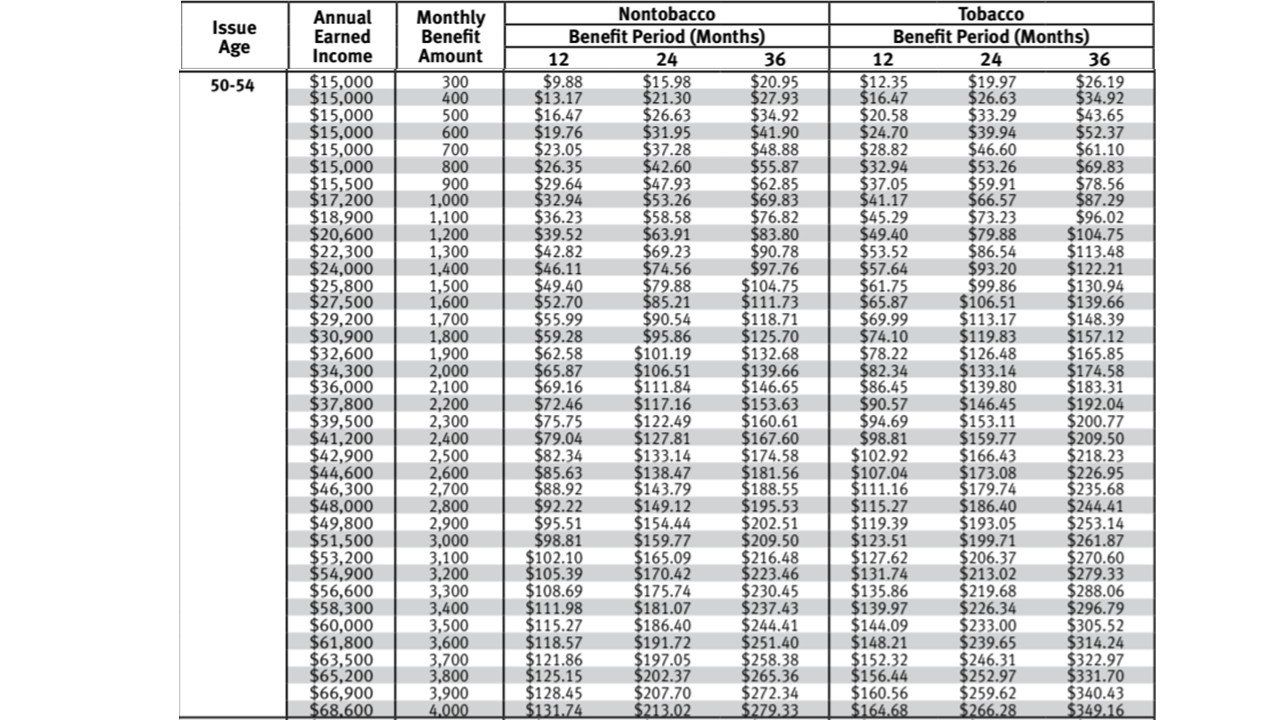

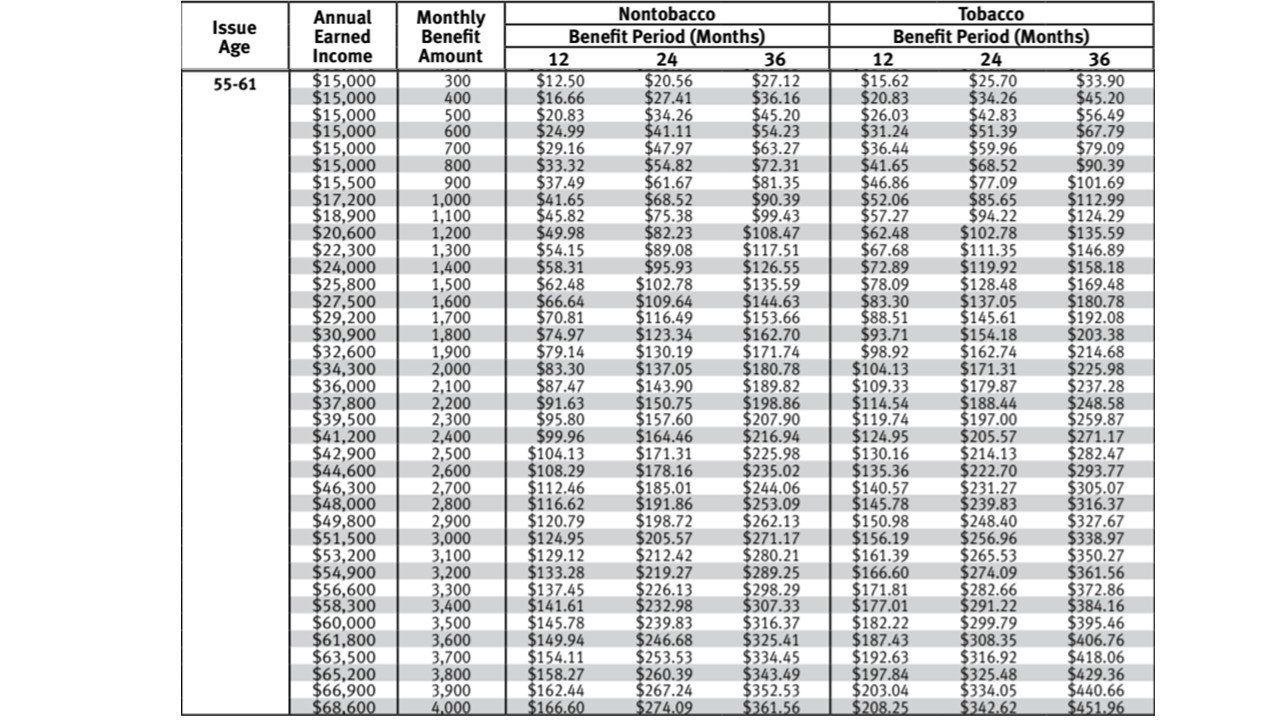

- Issue Ages 18-61

- Renewability to age 65

- Maximum Monthly Benefit of $4,000

- Elimination Period of 30 days for accident and 90 days for sickness

- Monthly Benefit Amounts from $300-$4,000 ( in $100 increments and up to 70% of net income)

- Benefit Periods of 12, 24 or 36 months

- Only price difference is for Tobacco or Nontobacco, Male and Female are same price

- Simple product, easy to understand (no riders)

- Affordable, clients choose their benefit amount and period to help fit cost to their budget

- Convenient, easy quote and e-App with knock-out questions, no medical exams or financial documentation required

- Fast protection, policies are issued in just a few days

- Inclusive, no occupation classes

- Predictable, coverage is issued as applied for (no exclusions, rate ups)

- Portable, protection is owned by you and not tied to your current job

Use arrows to look at prices per age.

This policy provides off-the job disability income insurance that offers

you a short application process, quick-issue

coverage and is portable. So straightforward,

no medical exam is required, just a series of

simple questions.